Let me be the last (hopefully) person to wish you a Happy New Year, it is February after all. 2022 has started off with stock market declines, ice storms, Omicron rates surging, and some welcomed retirements in the NFL. Most exciting, for those of us who call Cincinnati home, the Bengals are heading to the Super Bowl for the first time in 33 years. As a Cleveland native and Browns fan, this is a complexifier. My heart says “not fair” but after 12 years in Cincinnati, I cannot help but be excited for the team and this city.

Last week one of my partners, Tom Compton, discussed the Bengals and parallels with business turnarounds with the Cincinnati Business Courier. The article is well done, and you can read it here.

The It Factor

Regardless of your football allegiance, you must marvel at what Joe Burrow has done with the Bengals this season. At 25 years old, he’s been able to command a group around him and lead an organization. There’s that “it factor” that is intangible to a team and business that Joe has brought. Joe didn’t go to LSU to study leadership nor did he take exams on how to improve his “it factor.” Like Beethoven who composed his symphonies when he was deaf, there was no music theory class Beethoven took to become Beethoven. Through consistency, practice, and a focus on intangibles, Joe and Beethoven are who they are (and if I’m the first to compare the two I won’t be the last). The “value” assigned to Joe and by extension the Bengals is of course in how they score and perform, but a lot of it is in the intangibles not seen on the scoreboard.

As a merchant bank, RKCA both buys businesses and operates them (under our Direct Investment practice) as well as sells businesses on behalf of owners (under our M&A Advisory practice). We talk a lot inside our organization about these intangibles and the value assigned to them in a transaction.

Investment In Intangibles

Investment in intangible assets (IP, research, technology and software, human capital) has risen over the last quarter century. The pandemic has certainly accelerated this shift. As I write this article, I’m working from home to avoid this pending ice storm and have not lost connectivity to my colleagues thanks to Zoom and internal processes we’ve developed. Twenty-five years ago, when Joe Burrow was born, this wouldn’t be possible.

McKinsey & Co surveyed more than 860 executives last year and found that “top growers” – those companies in the top quartile for growth in gross value, invest 2.6x more in intangibles than low growers.1 McKinsey studied a broad range of sectors, and in all of them, those companies that invested in intangibles outperformed others.

It is my opinion that assigning value to these intangibles is becoming increasingly relevant in M&A transactions. Regardless of the industry you find yourself in, it’s my opinion that investing in them is not only critical to your organization’s long-term survival but also to maximizing the outcome when/if you do sell.

We’ve seen many examples of the investment in intangibles across sectors. A rollercoaster parts manufacturer investing in software and analytics and selling it to theme parks to improve throughput on riders. HVAC businesses investing in IoT technology to alert for repairs and maintenance needs in real-time. For those in Cincinnati, the foundational work Kroger did in the late 90s around data using the Kroger Plus card to make recommendations and the analytics around it has produced their 84.51 practice and focus as a grocer on alternative revenue streams beyond what is spent in store.

What Can You Do

If you’re reading this and wondering, “well my business is just so different, we don’t have the ability to build into intangibles” it’s my opinion you are wrong. These intangibles aren’t ONLY Intellectual Property that can be patented, or some sort of subscription model or data analytics.

The most important piece here is execution and consistency. If you are going to make the effort to invest in intangibles, you need to commit to it. As noted above, top growers from the McKinsey study invested 2.6x more than low growers in intangibles and deploy them effectively with a focus on embedding intangibles in day-to-day business operations. This requires a mindset shift for your organization. If the Cleveland Browns revolving door of quarterbacks can serve as a cautionary tale (27 QBs since 2004), you need to commit.

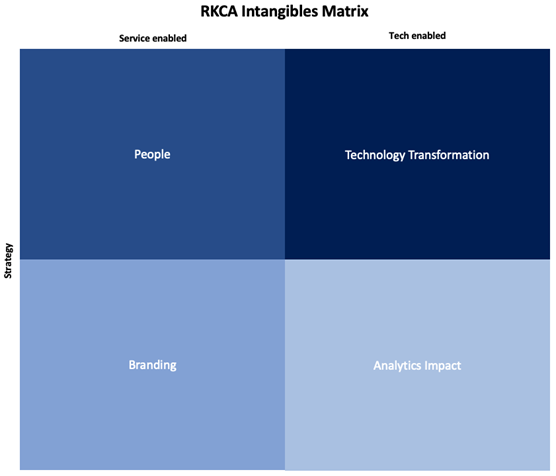

The RKCA Intangible Matrix

At RKCA, we’ve developed a Matrix to study and understand the various types of intangibles. Those four intangible segments are listed below, and if you’d like to learn more about what makes up the detail behind the Matrix, email me: nursic@rkca.com

Disclaimer:

The content of this material was obtained from sources believed to be reliable. However, RKCA does not warrant the accuracy or completeness of any information contained herein and provides no assurance that this information is, in fact, accurate. The information and data contained herein is for informational purposes only and is subject to change without notice.

This material should not be considered, construed, or followed as investment, tax, accounting, or legal advice. Any opinions expressed in this material are those of the authors and do not necessarily reflect those of other employees of RKCA. Market data proprietary to source cited, may not be reprinted, reproduced, or used without permission from the source or RKCA.

The content of this material should not be construed as a recommendation, offer to sell or solicitation of an offer to buy a particular security or investment strategy. Investing involves the risk of loss. Past performance is not indicative of future results. Investment banking services provided by RKCA, Inc., Member SIPC/FINRA. Non-securities related services provided by RKCA Services, LLC. 1077 Celestial Street, Cincinnati, Ohio 45202. Phone: 513.371.5533.

Securities offered through and investment banking services offered by RKCA, Inc., member FINRA/SIPC. 1077 Celestial Street, Cincinnati, OH 45202. Investing involves the risk of loss. Past performance is not indicative of future results. Click here for important disclosures as well as our Form CRS.

The person(s) providing the testimonial(s) herein have experience in the services that RKCA, Inc. provides. Their respective experience with RKCA, Inc. may not be representative of all other Clients of RKCA, Inc. Testimonials are not paid for by RKCA, Inc. Testimonials do not constitute a guarantee of future performance or success related to any product, transaction or service.

© Copyright 2022 RKCA. All rights reserved.